As macro volatility rises and traditional diversification tools become less reliable, investors need to rethink how portfolio protection is achieved. Since 2022, as fiat currency risk has structurally shifted higher, our view has been that precious metals offer a compelling real asset hedge within diversified private credit portfolios. With inflation proving more persistent in Australia and diverging from New Zealand’s easing cycle, we have been actively reallocating capital to reflect this thesis. This includes:

- Building our allocation to senior secured loans with late-stage precious metals projects that have hard-asset backing and visible cashflow pathways, while recycling long-duration commercial real estate exposures that remain sensitive to valuation risk in a higher-for-longer rate environment.

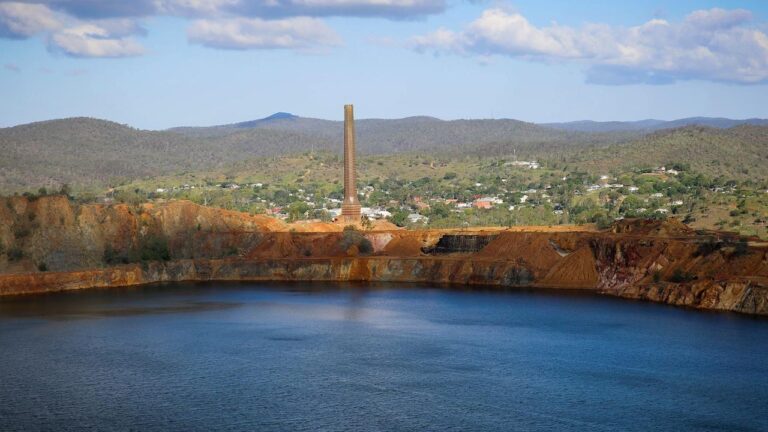

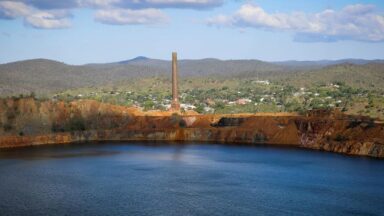

- Exposure to precious metals backed loans is currently 3% in the Merricks Capital Partners Fund with exposure to Heritage (Mount Morgan, QLD), a late-stage gold and copper restart project with production targeted for 2H26 and defined near-term cashflow milestones. Our initial credit underwrite of this loan commenced in 2022 when gold was ~US $1,800/oz, compared to the record highs of ~US $4,800/oz currently which embeds as further valuation headroom in the project.

- The forward pipeline includes Boab (WA), a lead-silver development asset, expanding metals exposure while maintaining a late-stage project bias and contracted offtake profile.

Resources transactions are being structured with conservative leverage, first-ranking security over project assets and step-in rights, ensuring capital preservation remains the primary return driver rather than commodity price optionality.

- We expect resources exposure to scale toward a medium-term allocation range of 10–15% in the Merricks Capital Partners Fund as additional precious metals and late-stage project opportunities are selectively executed in 2026 and 2027.

- As part of active duration management, the York Street Sydney office asset moved under contract this week for an expected February settlement, accelerating capital recycling and reducing portfolio sensitivity to long-duration valuation risk in a higher-for-longer rate environment.

This repositioning reflects a deliberate shift in portfolio construction toward reducing exposure to long-duration valuation risk and increasing allocation to shorter-duration, cash-generative real assets. The recycling of the York Street Sydney office exposure is a practical example of this approach. While higher headline pricing may have been achievable under a holding the asset for longer scenario, prioritising certainty of settlement, capital redeployment and risk management is more aligned with where we want the portfolio positioned.

Looking ahead, we also expect the divergence in monetary conditions across Australia and New Zealand to remain a defining feature of real asset performance. While we had previously expected fiscal restraint to moderate domestic inflation pressures, government spending has remained elevated and is now being complemented by the private-sector investment cycle into AI-related data, energy and infrastructure capital expenditure. Together, these forces are reinforcing demand for labour, construction and critical inputs, increasing the risk of structurally higher inflation. Against this backdrop, the Merricks Capital Partners Fund is positioned for a more inflation-sensitive environment through greater exposure to real asset-backed income, selective precious metals allocation and active portfolio rotation, all supporting the Fund’s objective of delivering investors returns of 8–10% in an uncertain macro environment.