- At Merricks Capital’s Investor Briefing, ‘The Surge of Private Credit’, held in Sydney last week, Accor Pacific’s CEO, Sarah Derry said Accor has seen a clear rebound across its 400 hotels in 2022, with domestic travel largely filling the void of lower international arrivals.

- Merricks Capital’s view is that as hotel room demand stabilises back to pre-pandemic levels, major hotel brands will be assessing existing stock to acquire new hotels to reposition below replacement cost to expand their footprint and offerings in the market. The short-term nature of our first mortgage funding is well suited to finance these projects.

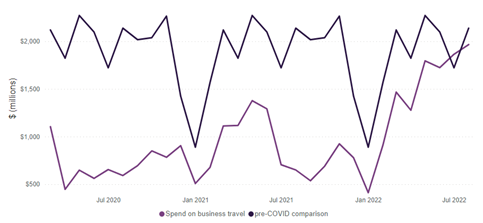

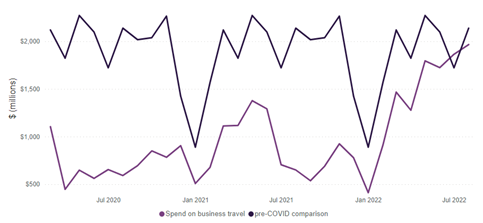

- According to Tourism Research Australia, business travel spending in August reached 92% of its pre-pandemic levels. When looking at daily data, Tuesday and Wednesday occupancy levels hovered between 65% and 75% respectively, and outperformed most Saturdays, which reflects an increase in business demand.

- In certain precincts we believe there will be a shortage in new stock to meet the increasing demand, since the pandemic period set back the commitment to many new hotel projects. We believe that a sensible commitment to fund new hotels in these zones is expected to constitute 10-15% of Merricks Capital Partners Fund’s exposure in 2023.

Spend on business travel compared to pre-covid period

Source: Tourism Research Australia

While international arrivals remain lower than 2019 levels, businesses and events are leading the return to capital city travel with improved hotel occupancy and daily rates. The return of foreign travellers in 2023 is expected to enhance the already robust activity.

We currently view completed hotel stock as an attractive investment sector since anecdotal evidence suggests traditional banks have been unable to fill borrowers’ capital requirements, due to their credit assessments often focusing more on historic market conditions (past 12-24 months) than being forward-looking.

We are currently financing one operating hotel, Porter House (Sydney) and financing the construction of two new hotels, The Melbourne Place (Melbourne) and Hotel Indigo (Auckland). We continue to look for one or two new opportunities to finance hotels that will benefit from the resurgence of travel and event activity.