Our 2024 macro-outlook commented on the market-implied view that reserve banks would aggressively cut rates over the coming two years as a best-case scenario and to be prepared for a slower path to cuts with negative real yields for longer. This week, markets reacted to entering this environment:

- guidance from the RBA & Federal Reserve indicated that rates would likely need to stay higher for longer to achieve inflationary targets;

- in our view, this is still a positive development, providing market participants with more clarity that aggressive rate cuts are not imminent and reducing the bid/ask spread between real asset transactions;

- our investment strategy targets lending to borrowers who are increasing the value of their underlying assets by completing projects that reduce the risk from higher for longer rates, as there is a value-accretive basis to our senior secured funding;

- there has been a noticeable increase in borrowers progressing refinances with banks and alternate lenders to repay our mature loans, with lenders more comfortable with the macro outlook than in 2023; and

- we have been lowering the attachment point of our investments over the past 18 months, with the average weighted loan-to-value ratio across our funds at 60%, down from 63%. Providing 35-40% of borrower equity on each project acts as a buffer to navigate any loan repayment delays or a softer real asset market.

Central banks were treading a cautious path over the past week, with both the RBA and Federal Reserve holding interest rates unchanged and the market adjusting back to our expected macro outlook that rates would need to be held higher for longer. On the other hand, the highly anticipated move for the Bank of Japan to hike interest rates for the first time in 17 years to 0-0.1% also highlights that there could be a longer tail to this interest rate cycle before central banks achieve their neutral rate targets.

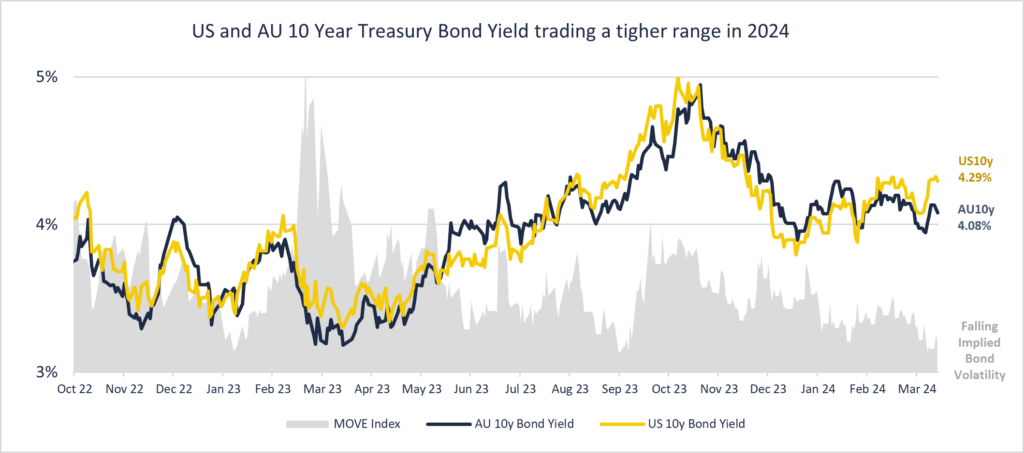

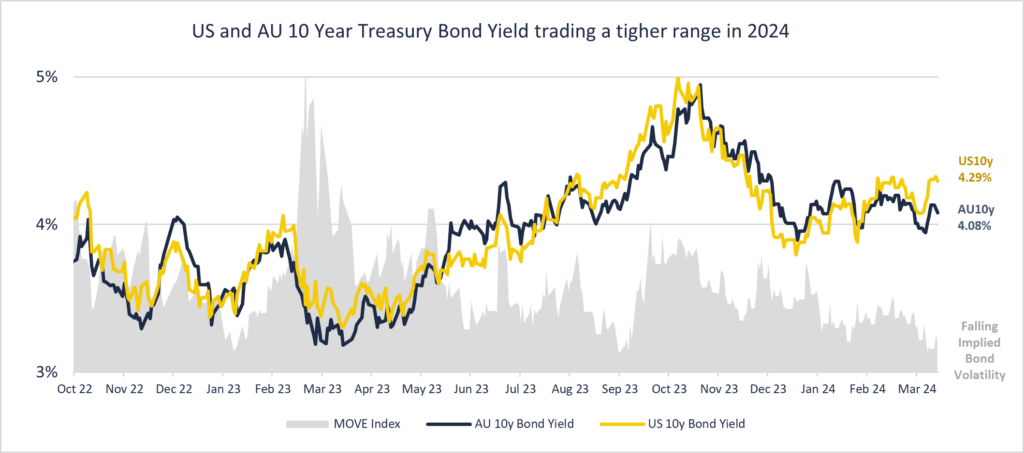

Significantly, bond markets’ aggressive pricing of rate cuts has since been trimmed back (from 7 cuts to 3 cuts in the US in 2024), reducing the volatility implied on bond yields (MOVE index below 100). 10y bond yields in the US and Australia have found a consolidated range between 3.9% and 4.3% this year, which provided some stability in the valuation of long-duration assets such as real estate.

Source: Bloomberg

Equity and bond markets are brushing off the strong Australian job data released this week (3.7% unemployment rate in Feb 2024) and hotter-than-expected US inflation data released last week (3.2% YoY CPI in Feb 2024) are signs that the market is comfortable with the broader trajectory of easing inflation and forward rates. This is in line with our view that run-away interest rates are unlikely to be a major forward risk for our first mortgage loan portfolios.

New highs in US equities markets have continued to keep a lid on credit spreads. Tighter credit spreads will translate to lower costs of carry for the Merricks Capital Partners Fund’s insurance protection through credit default swaps. We are committed to maintaining the Fund’s credit spread sensitivity to ensure the Fund is well positioned to participate in a convex payoff in the event of a macro credit crisis.