COVID-19 lockdowns in Shanghai are causing a fresh wave of disruptions to the global supply chain. The recent lockdown has crippled the world’s busiest container port and compounded the supply chain challenges lingering from 2020 and 2021.

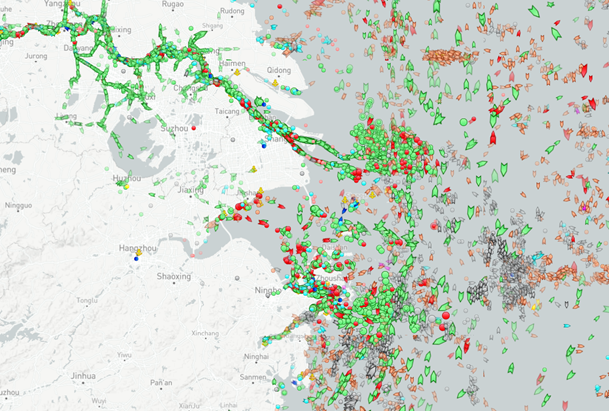

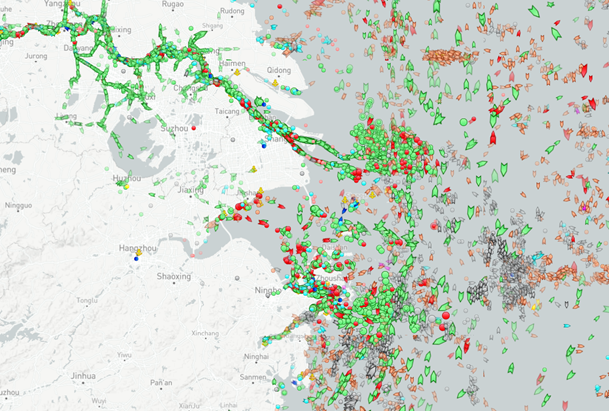

While the port has remained operational, critical labour and transport disruptions have pushed the number of ships waiting to load or discharge to more than 300, up from 50-75 in March this year. The image below shows the marine traffic in proximity to the Port of Shanghai on 20 April 2022.

Source: Marine Traffic

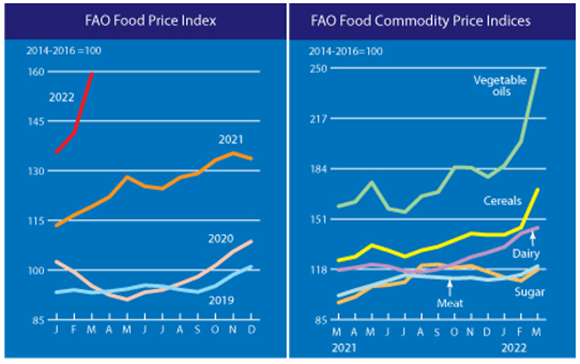

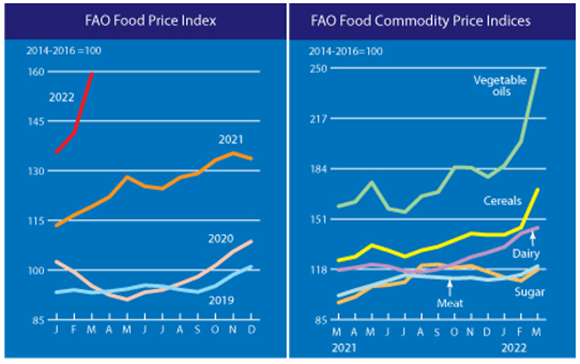

These disruptions are expected to drive inflationary pressures even higher as the move to “just in time inventory” policies that have taken hold over the last 30yrs are being challenged. The Food and Agriculture Organisation of the United Nations published March data for their Food Price Index showing world food commodity prices made a significant leap (+12.6%) during the month to reach their highest levels ever. The key factor for this jump was the impact of the war in the Black Sea region on staple grains and vegetable oils markets.

Source: Food and Agriculture Organisation of the United Nations

The Russia-Ukraine conflict will likely continue to impact food prices in the future, via constrained global supply of key agricultural inputs. Russia is a major exporter of potash, ammonia, urea, and other soil nutrients and as a result prices have increased 200%+ over the last year.

We are closely watching fertiliser prices as a key component to production in most agricultural industries, in particular, broadacre cropping, dairy and horticulture. In some instances, the pricing dislocations occurring in the fragmented global supply chain has created funding opportunities for the Merricks Capital agriculture credit strategy. At present, it is not a core strategy to fund working capital or inventory in the food supply chain, but it is an area of research we are exploring.

On a portfolio level, our conversations with borrowers show an acute awareness that rising input costs and labour shortages are not going to abate in the near term and working capital management is critical. Anecdotally, despite the operational challenges discussed many of our agriculture credit borrowers are experiencing record results, with buoyant commodity prices and favourable seasonal conditions. Of particular note is a number of borrowers who operate in sectors that are impacted by Chinese and logistic restrictions. Meetings this week with a large-scale winery and wine crushing business in Mildura it is on track to generate record profit, up 30% year on year as other Western markets have opened up for wine. Another, Harmony Agriculture & Food Co., one of Australia’s premium wagyu producers, generated its highest ever net quarterly profit in March 2022 having made the change from chilled to frozen export product at the beginning of COVID in 2020 as a way of reducing its exposure to supply chain delays and perishable product.

While we continue to actively manage for investment risks, from pre-pandemic levels we have seen no increase in borrower arrears across our Real Estate, Agriculture, and Infrastructure credit sectors. Our house view, as we’ve articulated previously, is that the normalisation of interest rates and tightening of central bank liquidity will curb growth rates and squeeze equity margins. We see the defensive nature of private debt investments as a strong hedge against these macro movements and a highly attractive risk adjusted return.