As arguably the best performing economy in a post-COVID world, New Zealand is currently at a crossroads.

- Rising asset prices have created a policy dilemma for New Zealand authorities, and the resulting tightening in lending standards has created a void in the senior lending market.

- Well supported asset prices are having a positive impact on the existing New Zealand assets in the Partners Fund and Agriculture Credit Fund, and limited competition for new investments is offering extremely attractive risk-adjusted returns

- The result has been an increase in the number of attractive investment opportunities across a range of Commercial Real Estate and Agriculture sub-sectors, and we would expect to see the exposure of the two Funds increase over coming months.

The New Zealand economy has been one of the best performing in the world, having experienced a much lower level of economic “scarring” due to the effective elimination of COVD-19. We saw evidence of this over the week with the NZ unemployment rate falling to an enviable 4.0%, even while the participation rate rose to 70.5%.

Business indicators in New Zealand are higher than pre-COVID levels and consumer and household consumption has been robust due to strong employment growth combined with low interest rates, TINA (“there is no alternative” spending overseas), and the wealth effect from higher housing prices.

But this wealth effect, a result of house prices rising almost 30% over the last year (the most of any OECD nation), has had an offsetting “poverty effect” and has led to the NZ Human Rights Commission launching a national inquiry into the property market.

The government has already changed tax rules for property investors (the NZ version of negative gearing) to try and dampen investor demand and stabilise prices and in a statement on Tuesday, the Reserve Bank of New Zealand said it is currently considering tighter lending standards including limiting higher LVR loans (LVR above 80%) to 10% of new loans (from 20% currently), the introduction of a debt-to-income ratio (DTI) to reduce serviceability risk, and/or the application of interest rate floors that banks would need to use as a baseline when doing serviceability assessments.

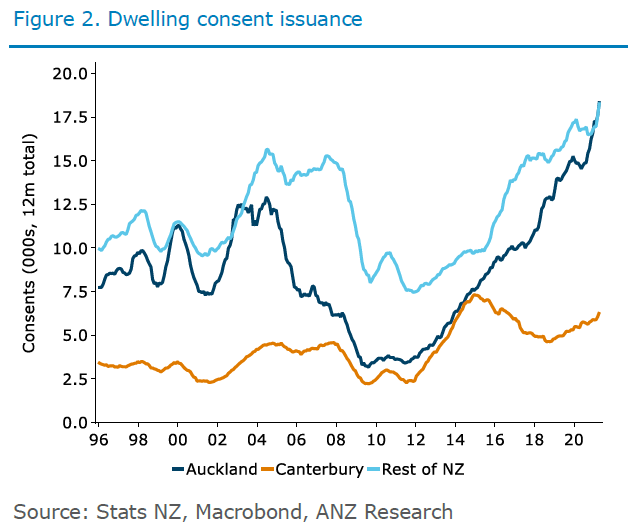

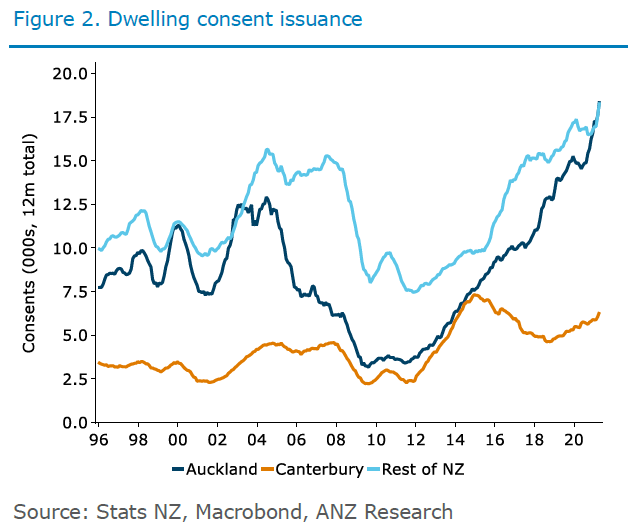

Housing supply has been growing rapidly to try and meet demand and dwelling consents (approvals) are now at the highest since 1974, suggesting that the pipeline of construction work will continue to increase.

The planned increase in construction will lead to higher demand for financing, at the same time as banks are facing more stringent lending criteria, creating a void in the senior lending market like that experienced in Australia in 2017.Merricks Capital has been expanding its presence in New Zealand across both the Commercial Real Estate and Agriculture sectors and it now accounts for almost 16% of the Partners Fund portfolio exposure.

The net impact of current market conditions on our portfolio is positive. The increase in asset prices has resulted in several of our investments being revalued, lowering the LVRs from their initial levels and reducing the risk within the portfolio

In addition, with many banks less willing to lend, we are seeing reduced competition for the higher level of financing demand. This means that on a risk-adjusted basis, the returns on the New Zealand investments under review are higher than those achievable domestically.

With the current media headlines and Human Rights Commission inquiry, the obvious concern might be that we are in a housing “bubble”. But outside of inner-city residential housing, asset price increases have been less extreme, and we feel comfortable that the valuations of the investments under review will be well supported in line with our conservative LVRs.

This week Merricks Capital settled two new loans. One of these is a $57 million agriculture loan secured against 17,000 hectares of (quality/A-grade/pristine) dairy farming land, running 30,000 dairy cows, in the northwest tip of Tasmania. This loan will be added to both the Partners Fund and the Agriculture Credit Fund and will provide investors with an IRR of ~8.7%.

A second loan of NZ$39 million is secured against four properties in Mangawhai (90kms north of Auckland) and Homestead Bay (12km south of Queenstown) in New Zealand. This loan will provide investors in the Partners Fund with an IRR of ~9.0%.