Our view as the largest non-bank lender in the Australian and New Zealand agricultural sector

- We’ve deployed over $1.3bn in senior secured loans into Australian and New Zealand agriculture over the past 5 years, making us the largest non-bank lender in the market. This is only a foothold in a sector that requires $8bn of investment per annum in Australia to grow from $79bn (2023) to $100bn of farmgate production by 2030 (DAFF).

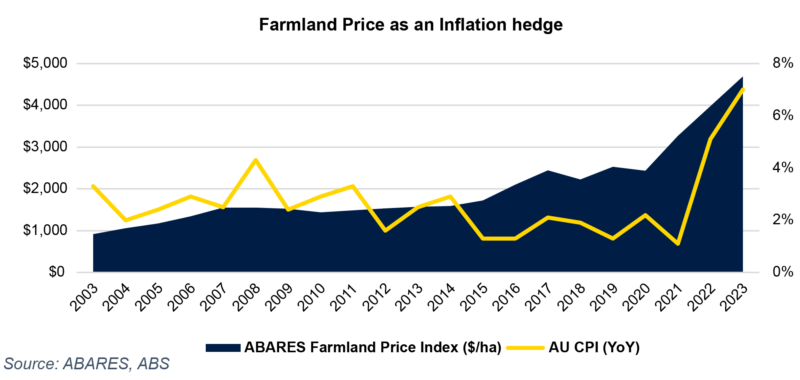

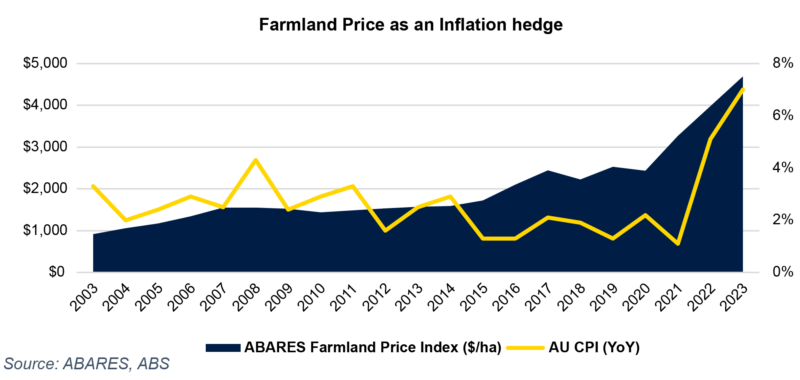

- Our experience managing credit investments in the sector indicates that agricultural credit is particularly powerful in a balanced portfolio as the underlying land assets and soft commodity production tends to outperform in an inflationary environment, demonstrating a lower correlation to macroeconomic factors (i.e. interest rate increases) compared to other traditional asset classes.

- Across our current 23 agricultural investments, we’re seeing properties transact in line with or above 2021/22 valuations but often take 3-6 months longer than last year. This additional sales time is, in part, why we structure agricultural credit at a lower LVR, with a weighted average LVR of 57% compared to commercial real estate at 62% across our funds.

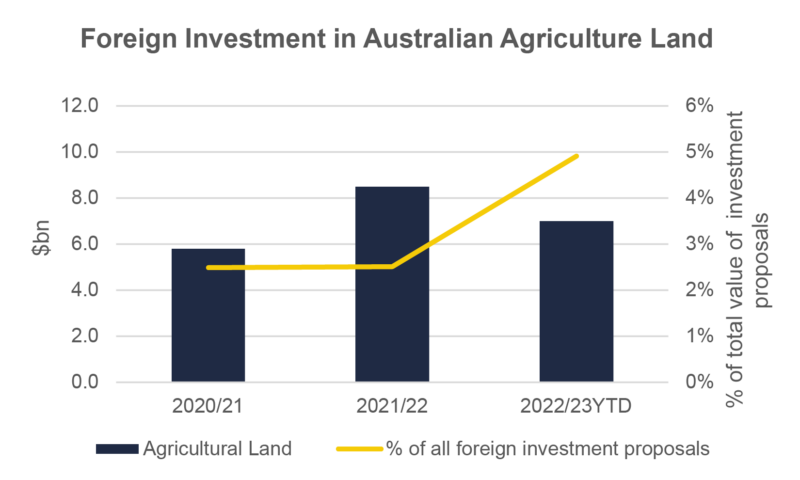

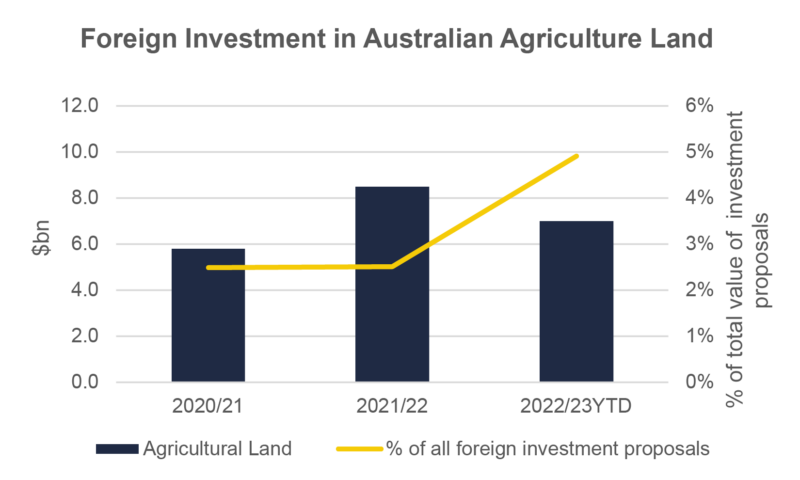

- Farmland transactions have continued to remain attractive to foreign investors in 2023, with long-term fundamentals around food production and a lower AUD seeing over $7bn in registered foreign investment approval proposals for agriculture, forestry, and fishing (Treasury – FIRB data), amid declining foreign investment appetite for other asset classes.

- We’re also seeing some of these businesses recapitalise with equity investment by institutional funds or UHNW individuals rather than straight asset sales. This enables the businesses to maintain a growth path to economies of scale while aligning with our debt exit strategy after the 1-3 year loan duration.

- Commodity prices have been correcting from 2021/22 highs, to previous 5-year averages, forming our investment thematic for our lending opportunities across horticulture, meat & livestock and supply chain processing assets.

Source: Australian Government, Treasury, Quarterly Report on Foreign Investment 2023

Our agricultural credit investment strategy has been evolving to target opportunities that we expect to outperform with lower commodity prices and a drier seasonal outlook, specifically:

- Horticultural & permanent plantings: While we expect fruit and vegetable prices to continue to be challenged for 2023, borrowers are saying input costs around fuel and fertiliser are easing, which should boost margins and industry optimism for expansion.

- Meat & livestock: Cattle prices have corrected 30-35% from 2022 highs in 2023, and with prices holding at current levels, we’re seeing opportunities to fund producers on lower valuations (<60% LVRs) and favourable lender covenants.

- Supply chain assets: We’re seeing banks looking to reduce exposure to these assets that have faced margin compression from global supply chain challenges. This presents opportunities to fund businesses with 3-4x interest coverage and debt to replacement asset values of 30-50%.

Over the past 12 months, we have intentionally reduced our exposure in the Merricks Capital Partners Fund from 31% agricultural credit to 17% to create capacity for us to redeploy into this sector as weather conditions normalise and commodity prices trade closer to 5-year averages.

Our experience in both agricultural debt and equity gives us a unique view of the current opportunity in private credit within this sector. While equity ownership can outperform debt in times of high production and asset value appreciation, seasonal downturns and commodity cycles are inevitable and private credit returning 10-11% across a diversified portfolio of senior secured asset backed loans remains our strongly preferred path to participating in this sector. Across our target sectors, we are assessing a pipeline of +$250m opportunities with a forecast weighted IRR of 11.3% (net of fees and costs) and a forecast weighted average LVR of 58%.