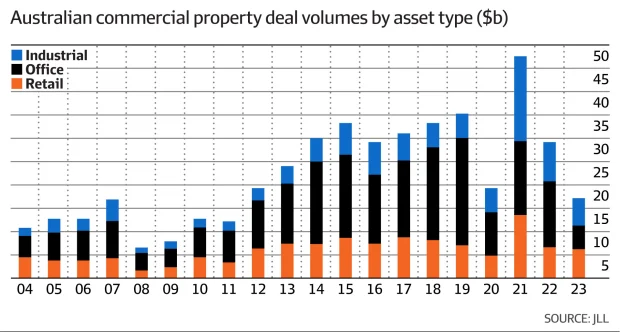

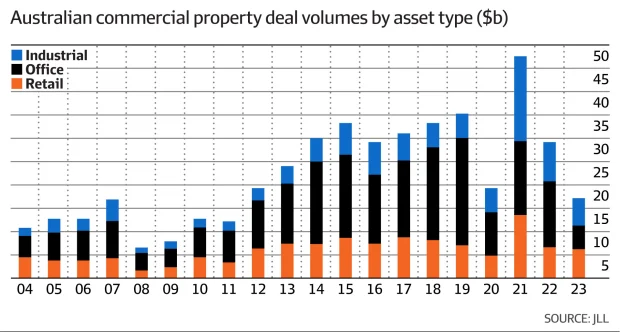

- 2023 was a subdued market for transacting commercial real estate (CRE), down 60% from CY21, with only retail transaction volumes holding near prior years. This afforded greater price discovery in the sector and a narrower bid/ask spread when transacting these assets.

- In 2024, we expect CRE transaction volumes to rebound from a 10-year low to reflect a more normalised year (~$25bn), with vendor expectations appearing closer to buyer appetite based on potential borrower enquiries and many listed REITs committed to recycling capital to redeploy into target growth sectors (prime office, industrial, etc).

- Over the past 12 months, the Merricks Capital Partners Fund has increased its retail allocation to 6% of NAV from 3% with two new loans: a large-format retail development in the outer suburbs of Adelaide and a site in the NSW central coast residential growth area. The weighted average LVR is 65%, and the expected investor IRR of the two investments is 11.5%.

- Retail capital values have shown to be resilient, with cap rate expansion estimated at 30-50bps since 2022 compared to the estimated expansion of 50-80bps for office.

- Our discussions with sales agents indicate a shift in the buyer profile for these assets from institutional to private investors and syndicators seeking counter-cyclical opportunities. Collectively, this investor set accounts for 77% of all retail acquisitions in 2023 (Colliers).

The macro drivers supporting retail values over the next 3-5 years include:

- Mismatched supply/demand from population growth, specifically in urban centres and growth boundaries;

- Higher construction costs, restricting new supply;

- Scarcity of suitable sites, as a result of large contiguous land holdings typically required for retail assets to be functional (parking, storage, loading, click and collect fulfilment, etc); and

- Non-discretionary retail (typically neighbourhood and sub-regional shopping centres) have remained attractive in a higher inflation environment with the ability to pass through rental increases linked to CPI.

We expect transaction volumes for retail to maintain 2023 momentum, with seven transactions in Australia totalling $650m currently in our investment pipeline. These potential senior secured loans are geographically spread (2 in QLD, 3 in WA, 1 in VIC and 1 in NSW) and meet our target metrics for specific locations, tenancy mix, high occupancy rate and suitable weighted average lease expiry and average debt to asset value attachment point of less than 65%.