Managing systematic portfolio risk amid China’s evolving economic landscape

- With approximately 60 loans in the Merricks Capital Partners Fund, no single loan presents a material risk to capital preservation and annual return outcomes. Systematic risk associated with economic activity and liquidity should often be investors’ primary concern.

- China’s uncertain outlook has been a point of speculation for markets of late. We see the declining GDP growth, ageing demographics and increasing debt levels as indicators that China’s economic ascendancy is slowing. While we don’t expect a rapid unravelling of China, it highlights the importance for credit fund managers to continue to think about mitigating this and other similar risks.

- Our long-held view is that maintaining a low-cost credit hedge that offers an exponential payoff in the event of a major macro crisis is sound risk management when earning +6-8% above the risk-free rate of return. Our low-cost credit hedge is approximately 50-60bps of annual performance.

- Fundamentally, our key protection against macro risk is at an individual loan level. Hence, we deploy capital into the safest part of a business’s capital structure (ranking senior secured) and take real assets at a modest LVR as our core collateral (Merricks Capital Partners Fund has a weighted average LVR of 61% and Merricks Capital Agriculture Credit Fund 56%).

- While we see the risk of a Chinese financial crisis as remote, the impact on Australia would be so material as our largest export partner ($178bn in 2020-21, DFAT) and a key capital provider to Australia’s real estate, education, tourism and retail sectors we will continue to maintain our credit insurance to mitigate the downside from this possibility.

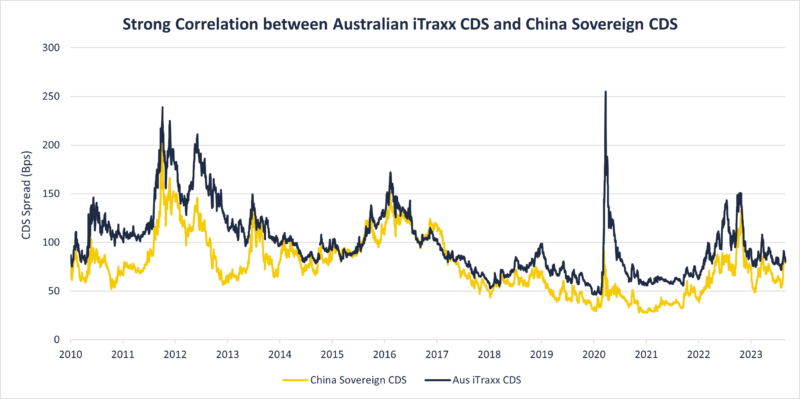

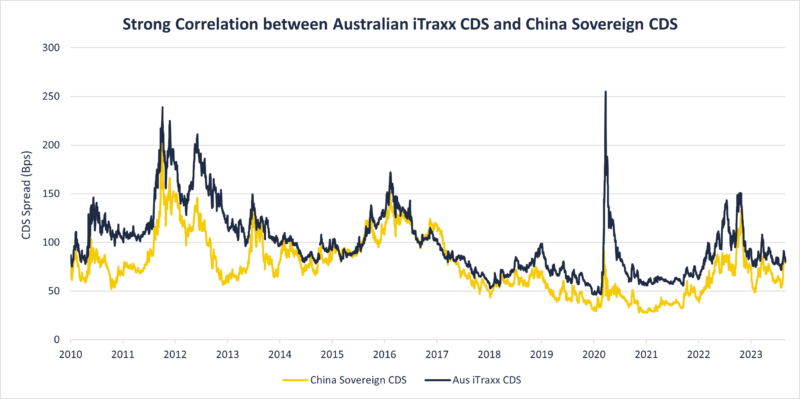

- The chart below shows the close correlation between China’s sovereign risk and the Australian iTraxx CDS that the Merricks Capital Partners Fund (the Fund) holds as part of its credit hedging strategy. iTraxx is composed of five-year credit default swaps for the 25 most liquid investment-grade Australian entities in the market. If China’s economy deteriorates, its sovereign risk would reprice and we would expect the CDS performance to be accretive to the Partners Fund performance.

Source: Bloomberg