- Over the last month Merricks Capital discovered very low levels of regional home vacancies whilst undertaking due diligence on several loans to fund coastal residential developments.

- Merricks Capital bottom-up engagement with agents and developers is reinforcing the trend Australians are choosing to live in regional areas, a shift accelerated by COVID-19.

- The Partners Fund has significantly reduced its exposure to the residential construction sector over the last two years as we have seen fewer developments in the cities and some aggressive pricing offered by other lenders.

- We are now seeing an increasing number of attractive investment opportunities in regional areas and expect this exposure to residential to grow again over coming months.

The demographic trend of net regional migration has accelerated as a result of COVID-19, assisted by the increased prevalence of flexible working conditions and demand for more space and less congestion.

This shift has led to an undersupply of owner-occupier residential construction in many regional areas, meaning developers of appropriately positioned housing have been seeing strong sales.

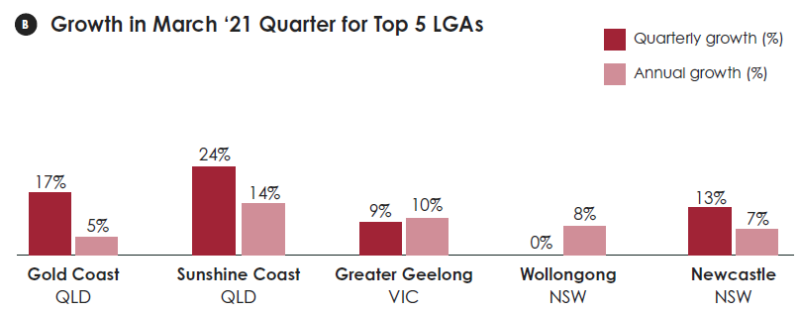

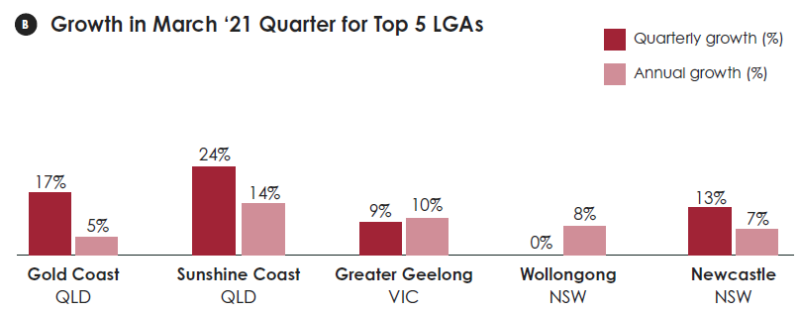

The CBA/RAI “Regional Movers Index” analysis shows that the biggest group of capital city dwellers moving to regional areas are targeting high population coastal centres close to capital cities. The Top 5 LGAs by share of capital to regional migration were The Gold Coast (11%), Sunshine Coast (6%), Greater Geelong (4%), Wollongong (3%) and Newcastle (2%). The growth in migration to these areas is shown below.

Source: CBA/RAI

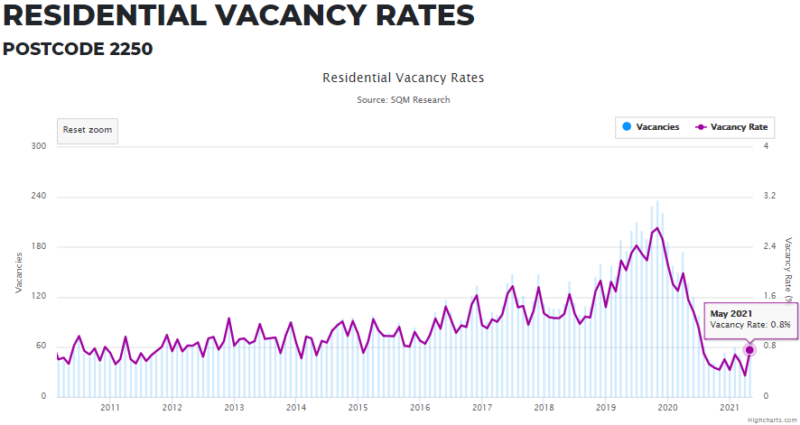

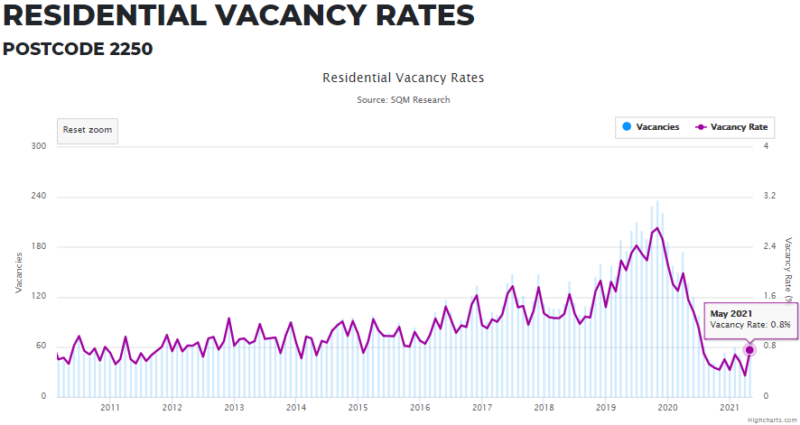

Last week we funded a construction loan for a project in Point Frederick, East Gosford, about 85kms north of Sydney. The average vacancy rate in Point Frederick has remained below 1% since August last year, after peaking at 2.7% in November 2019.

Source: SQM Research

There is limited supply in the area, and one other site currently under construction is almost fully presold. The timing of delivery and the nature of our development, which specifically targets the owner-occupier market, will see the project take advantage of the recent demographic trends.

The addition of this loan further diversifies the portfolio by providing increased exposure to the regional residential construction market and Merricks Capital expect to invest in further opportunities in this sector over coming months.

The investment pipeline remains strong, this week a $19 million cross-collaterised agriculture and land subdivision loan was added to the portfolio. The loan refinanced facilities predominantly secured against grazing properties in south-east NSW and ACT. It will also finance livestock purchases and development works for a land subdivision 60km north of Canberra.