Banks at capacity limits, flat asset growth and less income certainty in Australian agriculture is driving a new wave of private credit opportunities

- Bank activity over the past two years has seen the largest ever increase in agricultural lending with approximately $20bn of new credit across the major banks (Australian Banking Association). At $90bn total, many of these banks are fully allocated to the sector at a time when asset prices are under pressure and farm incomes are likely to be challenged.

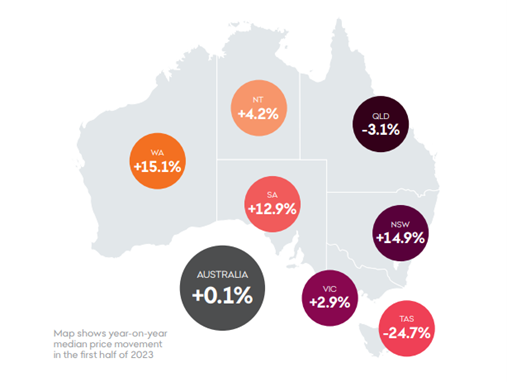

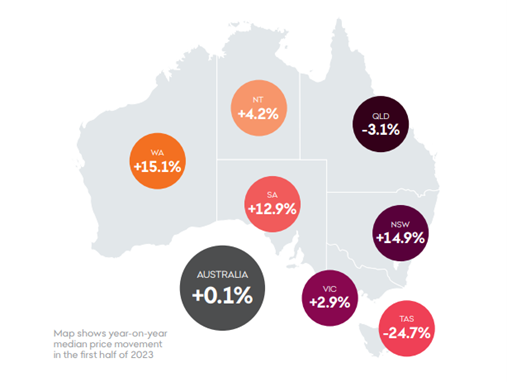

- We expect a rural land price correction of 5-10% from the 2022 highs based on what we’ve observed from our loan book transactions and the limited volume of rural sales in 1H23 (lowest in 28 years). The median price of farmland for the first half of 2023 was only 0.1% higher compared to year earlier (Rural Bank).

- We’ve managed this asset price risk across our 24 agricultural investments, which total +$700m of senior secured loans, by taking the following steps over the past two years.

We’ve lowered our attachment point against our secured assets from a weighted average LVR of 61% to 57%; and

We have specific sector selection and diversification. For example, our portfolio exposure in farmgate dairy has reduced to <1%, down from approx 12%. We’ve reallocated to downstream industrial dairy assets (milk processing and beverage packaging assets) where there’s an infrastructure and technology value-add by producing products that sell at a 100x the farmgate milk price (high value nutrients and proteins such as lactoferrin and alpha-lactalbumin).

- This creates opportunity for us to fund into a capital dislocation created by the banks and against assets highly resilient to drier conditions, including our focus on downstream industrial (as above), grazing land with carbon credits and farmgate horticulture (fruit, nuts, small crops). This strong pipeline includes the following investments which we expect to close over the next quarter:

$90m loan secured by northern territory cattle grazing land and carbon at a 50% LVR and IRR* of 11.9%;

$20m loan secured by Western Australian blue gum plantation and mixed farming assets at a 50% LVR IRR* of 9.5%;

$60m loan secured by small crop farms with high reliability water at a 51% LVR and IRR* of 11.6%; and

- This week, we settled a new agricultural loan with a South Australian cropping and grazing business. The loan allows the business to acquire a new grazing property and will then reduce debt to return to bank via documented asset sales. The loan is expected to return an investor IRR* of 11.1% and peak LVR of 47%, with a closing LVR of 29% in 24 months’ time at expiry.

Source: Rural Bank, Mid-Year Australian Farmland Values update 2023

* The internal rate of return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments