Western Australia’s open border is fuelling property development momentum in a market short of housing supply.

Strong economic performance and property market fundamentals are providing an attractive landscape for investment in the State and the return of interstate and international travel will boost competitive tension in the property market and create land development opportunities.

Our discussions with property developers indicate that they intend to capitalise on Western Australia’s housing shortage that has been described in the media as ‘critical’. The State is expecting an estimated 40,000 new / returning residents over the next six months and only an estimated 12,000 properties are available to rent or purchase.

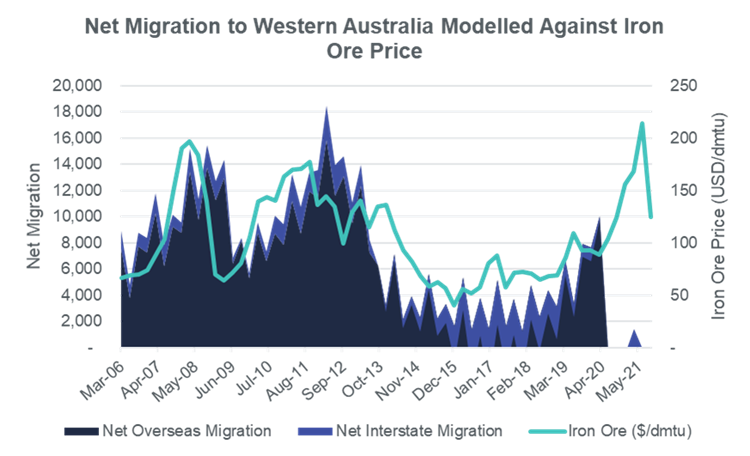

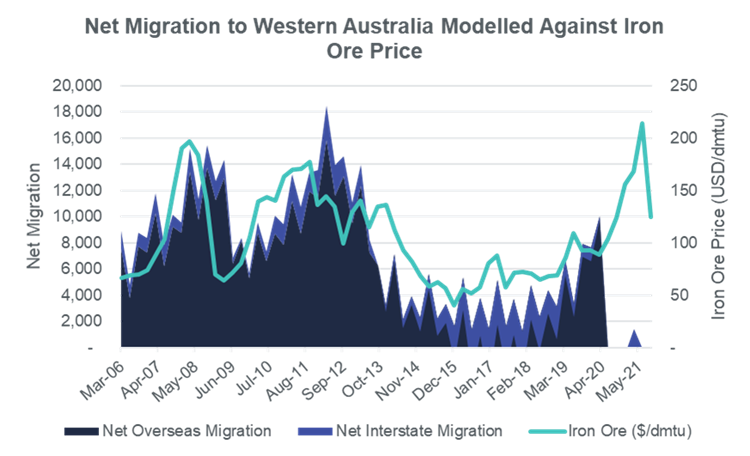

Economic performance in Western Australia is closely tied to the natural resource sector. Due to the contribution of iron ore to economic activity in Western Australia, $155bn in 2020/2021, net migration has historically been strongly correlated to the iron ore price. This relationship is highlighted in the graph below. Notably, the two-year border closure created a clear divergence between a buoyant iron ore price and net migration. As such, we expect to see a late cycle surge in overseas and interstate migration.

While we expect property development to create opportunity, we remain cautious on construction loans that will have to navigate rising construction input prices and labour shortages. Our two key mitigants against this risk are firstly the attachment point of our senior security on the investment asset, currently <56% across the Merricks Capital Partners Fund, and secondly, our comprehensive due diligence process that includes reviewing the project builder’s financial position to assess going-concern risk.

Source: ABS & World Bank

The first quarter of 2022 has seen increased travel for the Merricks Capital Investment team. The ability to extend our movement to the West Coast is creating opportunity, with our team reconnecting with existing borrowers and exploring new business opportunities in the State.

We currently have four investments in Western Australia totaling $90m and expected to reach financial close on a new investment of $22m in the next 30 days. Over the past three years, we’ve funded over $170m in Western Australia across commercial real estate projects and agricultural credit opportunities.