The Merricks Capital Partners Fund returned 1.0% in October and 10.4% on an annualised basis since inception. Underlying loan income performed strongly for the month (0.9%) with floating rate loans (representing 62% of FUM) benefiting from interest rate rises in Australia and New Zealand and additional

minimum interest resulting from early repayment on one specialised infrastructure loan. The Fund’s macro credit hedge saw Credit Default Swaps widen (0.10%) on increased credit market pessimism after the US Federal Reserve’s guidance that the Fed would rather overcorrect on rate rises to curb inflation than under correct over the next 12 months.

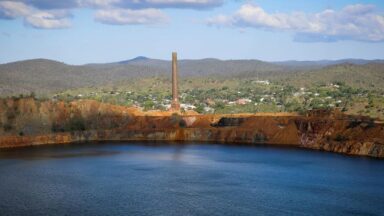

During the month, three loans totalling $52m were repaid in full, being two residential loans and a specialised industrial loan. Two new loans settled in October, $40m to fund a site acquisition for a strategic residential development in Auckland, New Zealand and a $25m farmland-backed loan to a Northern NSW cattle station business. Both loans reflect Merricks Capital’s continued commitment to fund strategic hard assets that have multiple paths to loan repayment at expiry. The forecast weighted average investor IRR of the new loans is 12.3% (net of fees).

As uncertainty remains around the terminal value of interest rates in Australia and New Zealand, we continue to closely monitor asset markets to understand the potential impact of any changes to underlying loan security. A key area of focus for October was the residential apartment market, where the following

was noted:

- Responsiveness to Net Overseas Migration (NOM) is a key driver of demand in this market and recent ABS data shows NOM is on track to reach pre-COVID pandemic levels by the end of 2022/23 financial year, which will result in population growth anticipated to increase by 1.4% over the next two fiscal years.

- Limited new stock pipeline. Apartment commencements and launches are the lowest in over a decade across Australia. Potentially, higher interest rates could push prospective purchasers into the apartment market as they are priced out of the detached dwelling market.

- Low domestic vacancy rates, rising rents and limited stock will also appeal to the investor market. Rising rental yields should offset softening asset prices from a gross rental yield perspective. According to CoreLogic, capital city gross yields (3.4%) are now at the highest level since November 2020.

Our assessment of opportunities in the existing apartment market both residual stock and construction is predicated on the borrower’s equity acting as a first-loss piece (usually 40% of the asset value). This remains an attractive risk-return investment and focus for our pipeline. Whilst we have experienced an increase in active loan management over the past six months as property owners and developers navigate rising capital costs and tighter credit liquidity we have not observed significant extensions in loan maturity profiles, primarily as a result of proactive steps taken to ensure repayment occurs via refinance or asset sales.