Over the past two years our funds only had a small exposure to completed apartment finance or as they are known in the industry, ‘Residual Stock Facilities (RSF)’. We are now seeing increased RSF opportunities with wider pricing, IRRs between 9-10%, in an environment where there continues to be lower lending capacity by retail banks and non-banks.

In the past three months we have closely reviewed over $450m in RSF opportunities and consider the following investment fundamentals as supporting the attractiveness of the sector for investors:

- RSF’s are secured against existing, completed commercial real estate that have clear exit strategies (sale of units). Repayment of RSF’s occur as sales are made and cash is swept at sales settlement, further reducing the facilities’ LVR’s, as sales are required to be made at or near their assessed valuations and always higher than the LVR. When financing completed apartments, a lender is also not taking construction industry risks which will continue to see challenges with builder solvency concerns and supply chain disruptions in 2023.

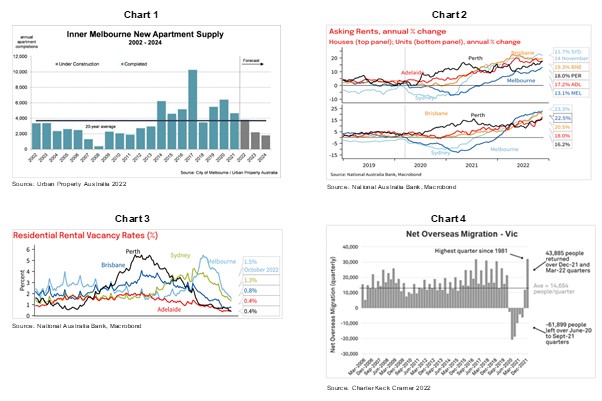

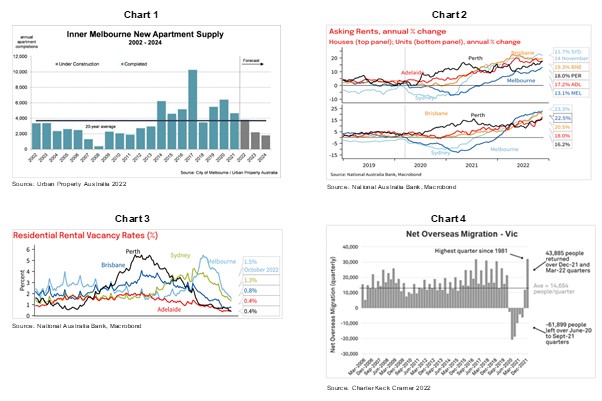

- Dislocation is driving this investment opportunity. Replacement costs have anecdotally risen 25-30% primarily due to rising construction costs and interest rates, which have resulted in fewer developers commencing projects over the past nine months (Chart 1).

- Lack of housing supply in key capital cities also appears to be a key contributing factor, with vacancy rates considered to be at all-time lows (0.9%) (Chart 2) and capital city rents up 16.5% since early 2020 (SQM Research) (Chart 3). Melbourne and Sydney apartments appear to be holding their values relatively well in the current rising interest rate environment. In Melbourne, where house values are down 6.7% since peaking in 2021, apartment unit values appear to have shown a slower decline at 3.1% (CoreLogic).

- The recent rebound in net overseas migration (Chart 4) is expected to contribute further to the supply shortage over the next 24 months. Net overseas migration is expected to fully recover to pre-pandemic levels of approx. 235,000 per annum by 2024/25 (NHFIC) and an estimated 36% of migrants are expected to enter the apartment market upon relocation to Australia (Charter Keck Cramer).

When assessing RSF opportunities, our due diligence includes extensive research and investigation into the underlying asset mix, sales strategy, build quality, independent valuations and loan facility mechanisms that sweep cash as sales occur.

Our current preferred RSF opportunities are inner-city locations with a mix of stock available in key capital cities with credible sales strategies and an equity buffer of at least 30% (our target Loan-to-Value ratio is typically <65%).

We currently consider the defensive nature of RSF credit and ongoing liquidity constraints in the lending market as opportunistic timing to increase our exposure to RSF’s. Over the next three months, we expect to settle $150m-$200m of new RSF loans which will increase our current portfolio RSF exposure from $125m (approximately 5% of total portfolio loans) to roughly $300m (being 12-15% of total portfolio loans) and returning investor IRR’s of 9-10% (forecast, net costs and fees).