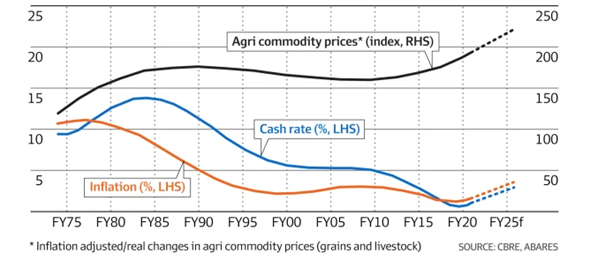

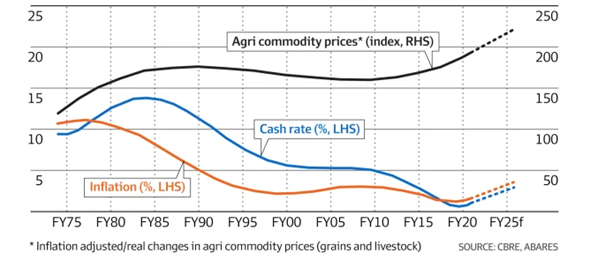

The current investment environment has radically shifted to a commodity driven inflationary super cycle. Historically during these periods, we have observed:

- Income from agricultural assets rise as inflationary pressures increase consumer prices, with revenue linked to commodity prices.

- Demand for agricultural and specialised infrastructure assets remain strong, as investors seek inflation and interest rate linked opportunities through turbulent markets.

- Hard asset credit strategies provide stability in times of rising interest rates and structural inflation. In its inaugural year, the Merricks Capital Agriculture Credit Fund has raised and deployed +$225m AUD of senior secured investments and is forecast to distribute 8% (net of fees & costs) for FY22. The Merricks Capital Partners Fund is also forecast to distribute 8% (net of fees & costs) for FY22.

Agricultural Commodity Prices Versus Cash Rate and Inflation Forecast

The FY23 macro-outlook for the Australian agriculture sector is strong. Favourable seasonal conditions and high commodity prices are expected to produce the second highest value of agricultural production on record at $80.4bn AUD (ABARES), just below this year’s record ($83.1bn AUD). This outlook is largely driven by the major broadacre sub-sectors – cropping, livestock and dairy. These sectors are approaching a third consecutive year of strong production conditions. Although rising input costs and labour challenges do present hurdles for primary producers, our extensive loan monitoring and meetings with our borrowers suggest that most have adequate supplies or cash reserves for the upcoming growing seasons.

Our track-record for managing agricultural credit is unique in the Australian and New Zealand market, with over $700m AUD of agricultural credit investments deployed over 26 individual investments. We have had no impairments since the strategy’s inception in 2018. The Merricks Capital Partners Fund has an average portfolio weighting of 35% to agricultural credit. Investors seeking exposure to agricultural credit as a single asset class have the option to directly invest in the Merricks Capital Agriculture Credit Fund.

We expect to reach financial close on $200m AUD of diversified agriculture credit loans in the next 60 days with a weighted LVR of <65% and forecast investor IRR of 10.5% (net fees and costs). We are currently underweight NZ agricultural credit, with only 10% of our loans in NZ which is down from approximately 35%. Based on the pipeline of expected settlements we anticipate this will be 20% by September 2022.

The combination of credit opportunities and macro-outlook will continue to generate compelling risk-adjusted returns from further deployment across agricultural credit in the Australia and New Zealand markets. With senior security over hard assets in both the Merricks Capital Partners Fund and Merricks Capital Agriculture Credit Fund, we continue to believe that fund investors are well-positioned to benefit from accelerating inflation.